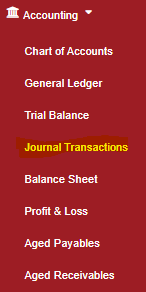

Click “Accounting” then “Journal transaction”

A page containing the journals saved will be displayed, you can search the journal using the search box on the right

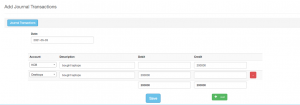

To add a journal click on “Add”, a page as shown below will be opened

For any journal transaction to occur one account must be Credited and the other one Debited or vice versa

Let us look at an example of how we can make a journal transaction in terms of a Loan that you have taken and how to repay it.

Say you borrow a loan of 200,000 to buy laptops for the school, then we will need to record the transactions of the money moving from the loan to the bank to the purchase of the laptops.

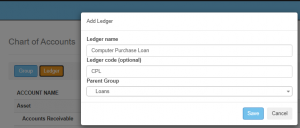

The first thing that we need to do is create a new ledger account for the computer loan. This will act as the loan account where the money is coming from to your own bank account. Click on ledger to add a new ledger account.

NOTE: One uses the add ledger option if the source of income is not related to the school system. i.e if I have other sources of income other than things like uniforms, fees, owners equity, etc.

Now, this Computer Purchase Loan account will act as the origin of the money that we need to buy the computers. i.e if I borrow money from KCB to buy the laptops then KCB will be represented by the Computer Purchase Loan acc.

Next, we now do the transactions where we receive the loan amount from the bank to our own bank account. So here we will Credit the Computer Purchase Loan Acc. and the Debit our own bank Acc. with the money.

To do this go to

- Journal transactions

- Click on the add button next choose the date,

- select the computer Purchase loan account which will be credited

- Choose the bank acc. that will be debited.

Use the green add button to add an account. Ensure that the credit is always equal to the debit side then click save.

The next thing is to buy the computers. There are two ways in which one can go about this process. The first being going to Asset purchases and then purchasing the assets from there which is ideal if you want to keep tabs on all the assets you have. The second option is recording the journal transaction where money moves from the bank acc. to the individual asset account.

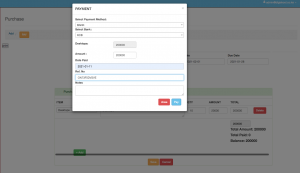

After the purchases then we need to record the various payments that are made toward the given loan. with this, you will need the principal amount, the interest, and the bank charge. Ensure that you have added an expense under expenditure called loan interest expense and bank charge since this will be expenses that the school will incur when paying for the loan.

Now to record the loan payment go

- Accounting

- Journal transactions.

- Add journal transaction

- Select the date

- Choose the bank where the money will be coming from, enter the description and then credit the amount.

- next click the green button to add the account for computer loan purchase then debit the amount

- next click the green button to add the account for interest loan expense then debit the amount

- next click the green button to add the account for bank charge expense then debit the amount

- Ensure that the amount on the debit is equal to the credit side.

- then click save.

This will be how you record all the transactions for the loan repayment in the journal transactions.